In our increasingly cashless world, having a credit card isn’t just about feeling fancy and showing off at Starbucks (use your app for this, btw).

It’s becoming more of a necessity than a luxury, especially when booking flights for that long-overdue Palawan trip or making emergency purchases when sweldo is still a week away.

If you’re reading this, you’re probably thinking about getting your first credit card. Maybe your officemates keep raving about their cashback rewards, or you’re tired of always borrowing your friend’s credit card to purchase your airplane ticket during a “piso-sale”.

Whatever your reason, we’ve got you covered.

In this guide, we’ll walk you through everything you need to know about credit cards in the Philippines, minus the financial jargon that makes your head spin.

We’ll tackle the basics (promise, we’ll keep it simple!), from choosing your first credit card and understanding interest rates to maximizing the rewards points.

Plus, we’ll share some street-smart tips on how to avoid those hidden fees that nobody warned you about.

What’s a Credit Card, Really?

A credit card is basically the bank lending you money to buy stuff now, with a promise that you’ll pay them back later.

It’s like having your own personal “utang muna” system, but with the bank!

Unlike borrowing money from your mom or your ate, though, you’ll need to pay this back with interest if you don’t settle up within the grace period (more on this juicy detail later!).

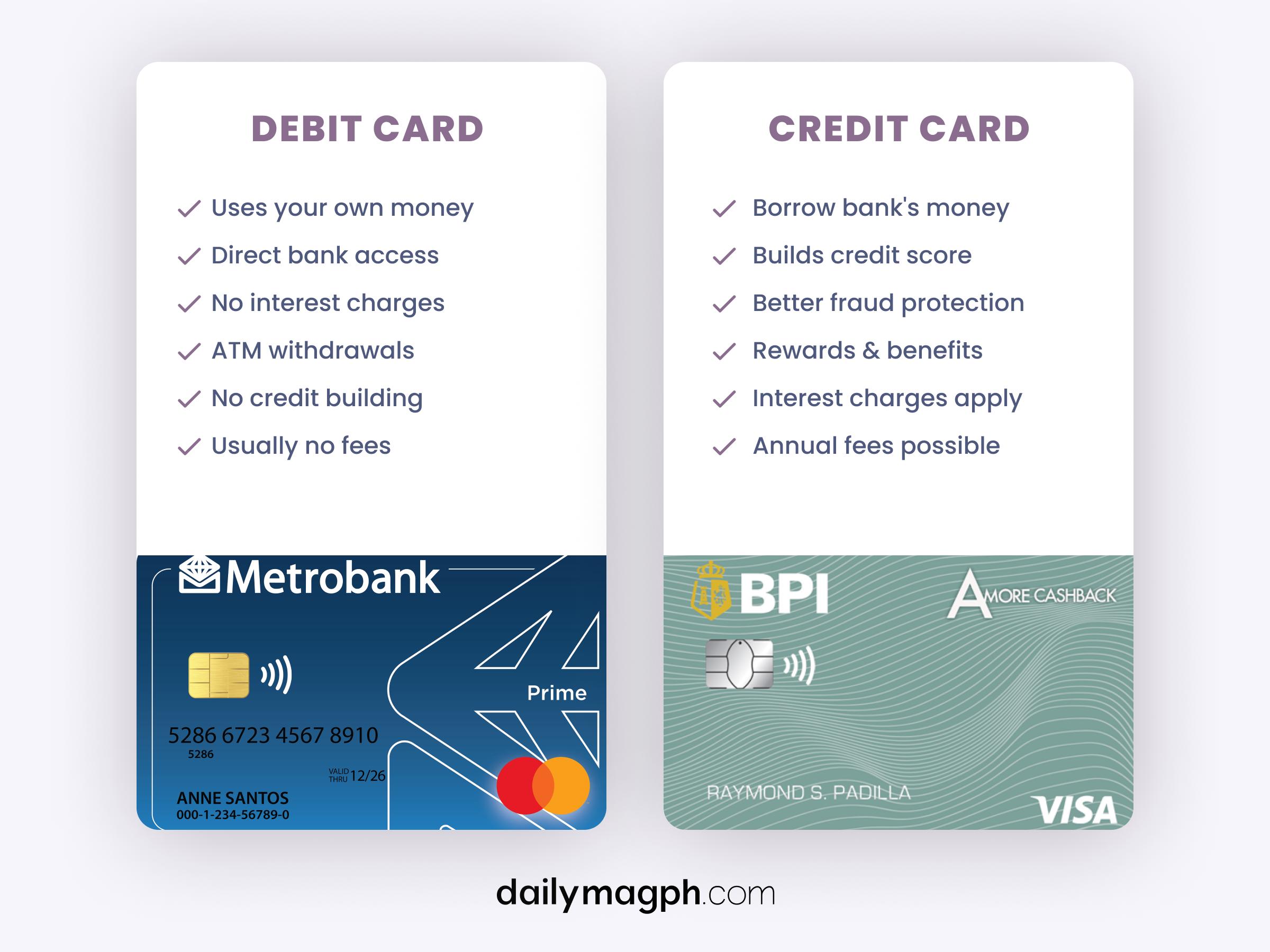

DEBIT CARD VS CREDIT CARD

Okay, let’s break this down into simple math:

- DEBIT CARD = Your Money

- CREDIT CARD = Bank’s Money (that you’ll need to pay back)

With a debit card, you’re spending your actual savings, your salary, or wherever your money came from—once it’s gone, it’s gone (sad but true).

But with a credit card, you’re spending the bank’s money first, which gives you more flexibility and more time to pay.

Here’s a clearer illustration of a Debit Card vs Credit Card:

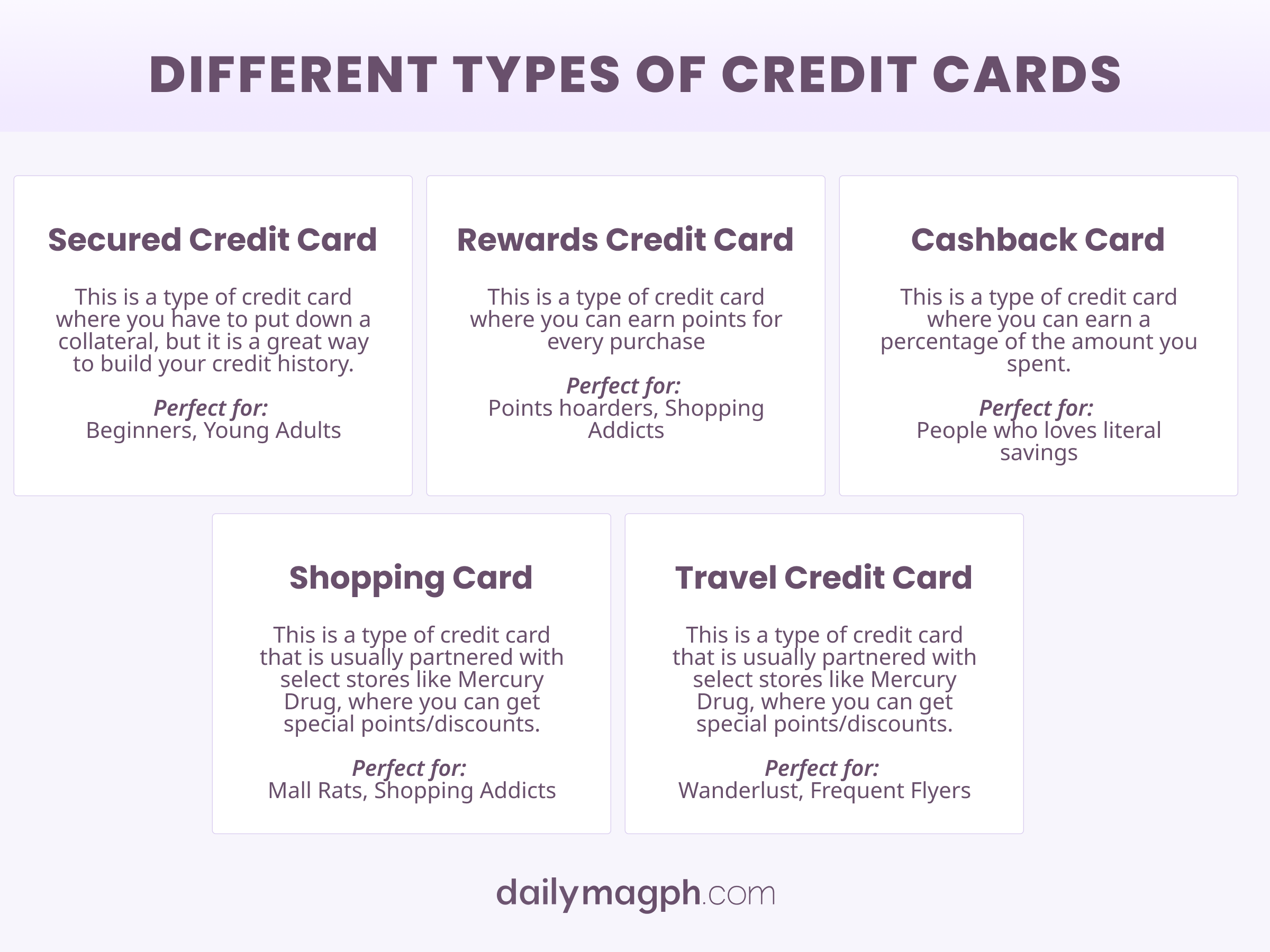

TYPES OF CREDIT CARDS IN THE PHILIPPINES

Pro Tip: Banks usually offer “secured credit cards” if you’re having trouble getting approved for a regular one.

Just deposit some money as collateral, and voilà – instant credit card!

Then you can just convert this to a regular credit card after 6 months to a year.

Getting Your First Credit Card

“Ay, ang hirap mag-apply ng credit card!” If you’ve heard this before, don’t panic! We’re here to spill the tea on how to score your first kaskas buddy.

Basic Requirements:

• Age: 21-65 years old

• Minimum annual income: ₱180,000-₱250,000 (varies per bank)

• Employment: At least 6 months – 1 year with current employer

• Valid IDs (The usual suspects: passport, driver’s license, UMID)

• Proof of income (COE, ITR, payslips – yes, they want receipts!)

• Proof of billing under your name (can be an account statement from your phone plan, your electricity bill; some would accept a barangay certification if you really have none of the proof of billing

The Application Journey: A Step-by-Step Guide

CHOOSE YOUR FIGHTER AKA YOUR BANK

- Check which bank has the lowest income requirement

- Pro tip: Start with the bank where you have a savings account. They already know your history so higher chances of getting approved.

- Browse online for ongoing promos (free annual fees, welcome gifts, etc.)

SUBMIT YOUR APPLICATION

- Option A: Online Application

- Visit bank’s website

- Option B: Branch Application

- Visit nearest branch

- Bring complete requirements

- Free aircon while waiting!

- Get to charm the bank staff in person 😉

FOLLOW UP (THE WAITING GAME)

- Processing usually takes 1-2 weeks, up to 6 months (Yes, I am talking to you RCBC!) depending on the bank

- Some banks will text/call you

- Don’t be shy to follow up after 2 weeks

- Practice your “professional voice” for call verifications

Getting approved for a credit card can feel overwhelming, especially if you’re new to the process. Don’t worry, you’re not alone!

If you want more chances of getting approved for a credit card, read some of our posts to get practical tips and easy-to-understand strategies that will help you build a strong application and increase your chances of getting approved.

RED FLAGS IN YOUR APPLICATION

- Submitting fake documents (just don’t!)

- Applying when you have existing loans

- Having bounced checks in your history

- Unstable employment history

⭐️ Remember: Getting rejected isn’t the end of the world! Think of it like dating—sometimes you need to meet a few banks before finding “The One.”

Understanding Your Credit Card: The “Fine Print” Made Fun(ish)

Let’s decode all that intimidating card jargon that makes your brain go “ERROR 404”!

CREDIT LIMIT

Think of your credit limit as your parents’ voice saying “tama na ‘yan!” but in digital form. It’s the maximum amount you can charge to your card.

• Regular credit limit: ₱20,000 – ₱50,000 (typical for beginners)

• Shared limit alert: Having multiple cards from the same bank? The limit might be shared!

• Your first credit limit isn’t your forever. Good behavior = limit increase

STATEMENT OF ACCOUNT (SOA)

Your statement of account or billing statement is where you can see your due date, total amount that you have to pay for the cycle, minimum amount due, fees, and the breakdown of your transactions.

Make sure to double check your transactions in your SOA for any double charges, or incorrect amount so you can file a dispute with the bank. That’s one of the best thing about credit cards, in case of any fraudulent transactions, you are using the bank’s money so you can file a dispute and the bank will help you.

BILLING CYCLES

STATEMENT DATE

Your statement date is when your billing cycle ends and the bank creates your monthly statement – think of it as your credit card’s report card showing all your purchases for that period.

- When your “tab” for the month is finalized

- Usually same date monthly

- Lists all your “damage” for the period

DUE DATE

The due date (usually 21-25 days after your statement date) is your deadline to pay your bill.

GRACE PERIOD

The sweet spot between purchase date and due date

• Pay in full during this time = NO INTEREST!

• Usually around 21-25 days (depends on the bank)

Sample Timeline:

Statement Date: July 15

Due Date: August 5

Grace Period: July 15 – August 5

Pro tip: mark these dates on your calendar or set phone reminders so you never miss a payment and keep your credit history squeaky clean. 😉

FEES

ANNUAL FEES

- Range: ₱1,500 – ₱5,000

- Usually waived for first year

- Pro tip: Call your bank and negotiate for a waiver!

- Some cards now offer NO annual fees forever (yes, they exist!)

LATE PAYMENT FEES

- Fixed amount (around ₱850) or percentage of balance

- Plus points for your anxiety levels

- Totally avoidable if you pay on time!

OVERLIMIT/OVERDRAFT FEES

- When you exceed your credit limit

- Around ₱500 per instance

CASH ADVANCE FEES

- Using your card to withdraw cash

- Usually 5% of amount withdrawn

- Higher interest rates apply

- Our advice? Stay away from this!

INTEREST RATES

Credit Card interest rates is something you’ll definitely want to understand before diving into the credit card world to avoid being in debt.

Most banks charge a monthly interest rate between 2% to 3.54% (or around 24% to 42% annually) when you don’t pay your full balance on time.

Think of it this way: if you have a ₱10,000 balance and your card has a 2% monthly interest rate, you’ll need to pay an extra ₱200 just in interest charges if you only make the minimum payment!

That’s why it’s super important to pay your full balance each month to avoid these interest charges eating up your hard-earned money. 😊

How to Avoid Interest Charges:

Avoiding interest charges is simple. It’s basic. It’s utang, therefore you pay for it. All you have to do is pay your full balance before your due date and you can avoid the interest charges.

So basically the rules are:

- Pay your FULL balance before due date

- Don’t do cash advances (because they have high interest rates and fees)

- Avoid installment plans with interest

- When in doubt, refer to #1!

THE FINANCE CHARGE FORMULA (for the brave souls):

Outstanding Balance x Monthly Interest Rate x No. of Days / 30 days

This is the formula for the daily credit card finance charges if you won’t pay your full balance.

But honestly? Just pay in full and on time! It’s easier than memorizing this formula!

❗️Remember: Credit card interest compounds daily! It’s like your utang growing faster than your plants during lockdown. Not cute!

The last swipe

Now that you already know everything you need to know about your first credit card, I hope you make the right financial decisions. Your credit card can be your best friend or your worst enemy.

Ready to Start Your Credit Card Journey? Here’s Your Game Plan:

- Check your finances first

- Research different card options

- Prepare your requirements

- Apply to ONE bank at a time

- Use responsibly (promise?)

Now go forth and swipe responsibly! May the credit card gods be ever in your favor! ✨

Comments